Warning: Never Sell This TSX Growth Stock

Constellation Software (TSX:CSU) might be the greatest stock in Canadian history. Its performance is beyond comparison. Since going public in 2006, shares have risen by 8,000%. Patient investors made 80 times their original investment.

© Provided by The Motley Fool Red siren flashingThat’s impressive, but what about the future? Lucky for you, the run is ready to continue.

Load Error

Pay close attention

As its name suggests, Constellation is in the software business. If you want to grow your money as quickly as possible, this is the place to be.

Software is unlike any other product in human history. For centuries, businesses needed to create actual physical products to sell. This is still largely true today. To sell you an iPhone, Apple literally needs to manufacture another iPhone. There’s no other way around it.

Hardware has a few obvious downsides, the biggest of which involve cost, time, and repeat purchases.

By selling software, Constellation doesn’t need to spend more money to acquire additional customers. All it needs to do is send another download link. Lead times also collapse completely, whereas physical products take days or weeks to make.

Finally, software is often sold on a subscription basis, with customers paying regular licence fees to maintain access. That creates a high-margin cash flow machine. Physical goods, meanwhile, can only be sold once, meaning you need to consistently convince customers to buy a new and improved product.

Video: Global dividends have fallen but they are still to be found in some sectors (CNBC)

Global dividends have fallen but they are still to be found in some sectors

UP NEXT

Software products can scale worldwide in a matter of hours. They generate higher margins and greater returning customer rates. These basic factors have fueled Constellation’s meteoric ride.

As we’ll see, the company also applies a unique spin to the software model, one that should pay dividends for years to come.

Constellation stock is roaring

Constellation is a $30 billion tech giant, yet few have ever heard of it. That’s because the company focuses on enterprise software aimed at niche audiences. Some of its products are only applicable to a single industry or use-case.

Going niche sounds like a bad thing, doesn’t it? It’s true that smaller markets reduce the overall sales potential, but they also limit competition. In many of its markets, Constellation faces zero competition. This raises profits margins and customer retention rates even more.

Because each individual product has a smaller overall potential, the company needed to amass a large portfolio. Today, it has hundreds of products across dozens of industries, and it’s still acquiring more every year. At the smaller end of the acquisition market, competition is similarly limited, lowering purchase prices. It’s a win-win situation.

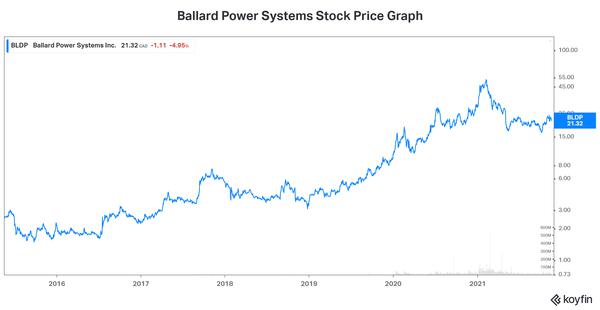

Since 2020 began, Constellation stock has risen by another 20%. The downturn could actually benefit the company, as competition for acquisitions should fall even more. Plus, many of its products help automate key processes — an attractive option in a world intent on cost cutting.

Constellation has a proven business model. The stock rose 8,000% based on this approach alone. All the company needs to do is rinse and repeat again and again. To be sure, the biggest days of growth are likely behind it, but CSU stock should continue to outpace the overall market.

Our top software stock pick was just released below.

This TSX Stock Could Hold The Key to What 1 CEO Says Is Worth 35 Amazons

WHAT in the world could be worth “35 Amazons”? The answer is a radical breakthrough that Wired says is “the rocket fuel of the AI boom.”

We encourage you to act quickly if you want to get in on this opportunity, because the story of the coming boom is already starting to leak out and this trend looks ready to take off.

Simply click on the link below to get more information.

Learn More Today!

More reading

David Gardner owns shares of Apple. The Motley Fool owns shares of and recommends Apple and Constellation Software. Fool contributor Ryan Vanzo has no position in any stocks mentioned.

The post Warning: Never Sell This TSX Growth Stock appeared first on The Motley Fool Canada.

Continue Reading-

Latest

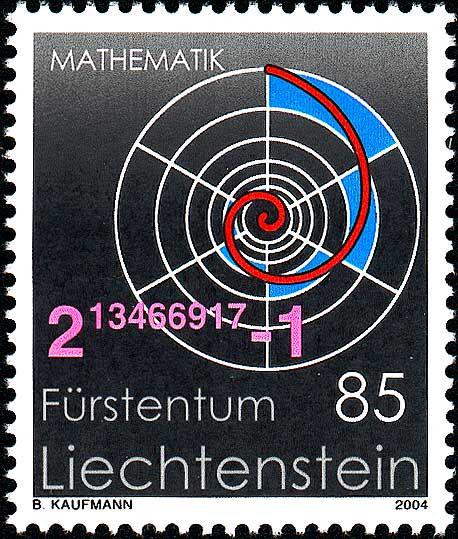

What is the biggest number in the universe?

What is the biggest number in the universe?What is the biggest number in the universe?Googol. It is a large number, unimaginably large. It is easy to write in exponential format: 10100, an extremely compact method, to easily represent the larg...

-

Next

These are the biggest numbers in the universe - Gizmodo

These are the biggest numbers in the universe - GizmodoThere are numbers out there that are so enormously, impossibly vast that to even write them down would require the entire universe. But here's the really crazy thing...some of these incomprehensibly h...

Popular Articles

- Rocket Power (TV Series 1999–2004) - Rocket Power (TV Series ...

- technique - What is the definition of 'playing in the pocket ...

- "Pocket rockets," in poker Crossword Clue Answers, Crossword ...

- 5 Sex Toys Every Man Should Own, Use & Use Again - LA Weekly

- Pocket Holsters: 11 Options For Easy Everyday Carry (2021 ...

- What is Elton John's most successful song? (Celebrity Exclusive)